[ad_1]

- Euro surrenders its initial advance to 1.0930 vs. the US Dollar.

- Stocks in Europe maintain daily gains in place on Tuesday.

- EUR/USD comes under pressure following a test of 1.0930.

- The USD Index (DXY) reverses the initial drop to the 103.00 region.

- EMU Current Account surplus widens in June.

- Fedspeak and housing data will be next on tap in the US docket.

The Euro (EUR) fades the initial optimism against the US Dollar (USD) and now forces EUR/USD to return to the sub-1.0900 zone following earlier multi-session peaks around 1.0930 on turnaround Tuesday.

The ongoing knee-jerk in the pair comes pari passu with some recovery in the Greenback after the USD Index (DXY) challenged the 103.00 neighbourhood earlier in the session.

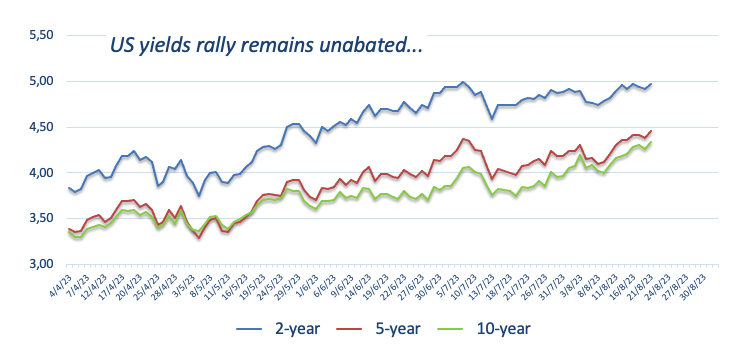

The renewed selling pressure in the Dollar, in the meantime, comes amidst the so far small correction in US yields across different maturities. On this, the short end of the curve continues to flirt with the 5.0% threshold, while the 10-year benchmark hovers around levels last seen in November 2007 past the 4.30% yardstick.

Taking a broader view of monetary policy, there has been a resurgence in the discussion surrounding the Federal Reserve’s commitment to maintaining a more restrictive policy for an extended period. This renewed focus is a response to the US economy’s resilience, even in the face of a slight easing in the labour market and lower inflation readings in recent months.

Within the European Central Bank (ECB), internal disagreements among its Council members regarding the continuation of tightening measures after the summer period have emerged. These disagreements are contributing to renewed weakness that is negatively impacting the Euro.

Looking ahead, market participants are anticipated to adopt a cautious stance in light of the upcoming Jackson Hole Symposium and the speech by Chairman Jerome Powell in the latter half of the week.

In the domestic calendar, the Current Account surplus in the broader euro area widened to a seasonally adjusted €35.84B in June.

In the US docket, July’s Existing Home Sales are due along with the regional manufacturing gauge by the Richmond Fed and speeches by Richmond Fed Thomas Barkin (2024 voter, centrist), FOMC Governor Michelle Bowman (permanent voter, centrist), and Chicago Fed Austan Goolsbee (voter, centrist).

Daily digest market movers: Euro meets initial hurdle around 1.0930

- The rebound in the Dollar drags EUR/USD below 1.0900.

- The appetite for the risk complex now loses some traction.

- US 10-year yields reach multi-year highs beyond 4.30%

- Markets’ attention remains on the Jackson Hole gathering.

- Fed’s tighter-for-longer narrative keeps hovering around investors.

- The Fed is likely to maintain rates unchanged until Q1 2024.

Technical Analysis: Euro faces immediate contention at 1.0844

EUR/USD extends Monday’s decent advance and reaches new multi-day peaks around 1.0930, where it has so far met quite a decent resistance.

In case the recovery picks up a more serious impulse, EUR/USD is expected to meet an interim barrier at the 55-day SMA at 1.0961 prior to the psychological 1.1000 the figure and the August high at 1.1064 (August 10). Once the latter is cleared, spot could challenge the weekly top at 1.1149 (July 27). If the pair surpasses this region, it could alleviate some of the downward pressure and potentially visit the 2023 peak of 1.1275 (July 18). Further up comes the 2022 high at 1.1495 (February 10), which is closely followed by the round level of 1.1500.

In case bears regain the upper hand, the pair could retest the August low of 1.0844 (August 18) ahead of the July low of 1.0833 (July 6). The breakdown of the latter exposes the significant 200-day SMA at 1.0795 ahead of the May low of 1.0635 (May 31). Deeper down, there are additional support levels at the March low of 1.0516 (March 15) and the 2023 low at 1.0481 (January 6).

Furthermore, the positive outlook for EUR/USD remains valid as long as it remains above the important 200-day SMA.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

[ad_2]

Source link

THE NAIS IS OFFICIAL EDITOR ON NAIS NEWS